Last updated

How Strong Customer Authentication works

This article gives an overview of Strong Customer Authentication, a way to add additional security to online payments required by European legislation.

Table of Contents

European regulation requires Strong Customer Authentication (SCA) for online payments from European customers.

This means that customers are sometimes asked to verify their purchases by an additional security layer called 3D Secure 2. Typically, this means that an online payment has to be verified via a customer’s online bank or mobile verification when conducting the payment.

The default transaction process of Sharetribe Flex and the Sharetribe Web Template offer out-of-the-box support for SCA. This article clarifies how exactly transactions using SCA will work in the default process.

Remember that this is just a default: you can make adjustments to this process as you wish, as long as you comply with the SCA requirements when dealing with payments by European customers.

How payment with SCA works

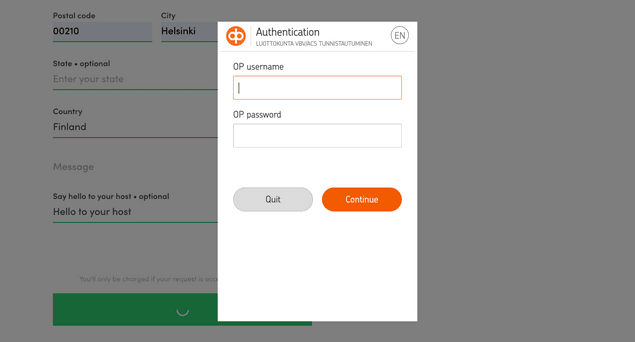

From the customer's perspective, most transactions are business as usual: they make the payment normally by entering their credit card details, and that's it. However, on some occasions, they are presented with a popup that requires them to connect to their online bank to verify the transaction. The experience that follows depends on the bank of the customer. Each bank has their own user interface for this process. The example below is from a Finnish bank Osuuspankki.

At the point when the popup is presented, the transaction has already been initiated. If your marketplace is using availability management, the corresponding slots have been booked from the calendar of the provider, and the provider already sees that a transaction has been initiated if they go to their inbox. They also notice that it's still pending payment verification.

By default, the provider doesn't get an email notification about the transaction yet at this point because the payment has not yet been completed.

The customer now has 15 minutes to verify their transaction through their online bank. If this is done successfully, their credit card is preauthorized normally, and the provider is notified of an incoming booking by email.

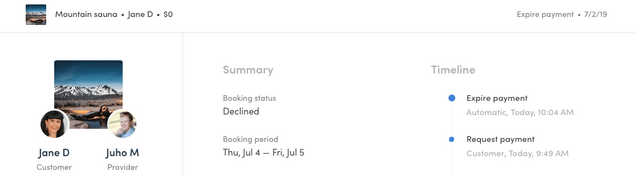

If the customer fails to verify the transaction during the 15-minute timeframe, the transaction is automatically moved to the state "payment expired". At this point, the booking is canceled, and the booked dates or time slots are freed. If the customer wanted to try the purchase again, they'd have to initiate a new transaction. Both parties will continue to see the expired booking in their inboxes.

What to do if SCA fails?

If the customer fails to verify the transaction within the 15-minute timeframe, it's probably a good idea that you contact the customer in question to ask what went wrong. After all, they entered their credit card details and pressed the button to initiate the booking request, so they clearly want to go through with the booking. In Console, you can easily see all the transactions that failed because a payment expired.

If you want, you can also decide to notify the provider automatically by email if there's a failed payment. This allows the provider to go to their inbox and send a message to the customer to help them complete the booking.

Should you use SCA in your marketplace?

If you want to be able to accept payments from European customers in your marketplace, your payment process must support SCA starting from September 14th, 2019. After this date, payments done by European credit cards with a payment process that doesn't support SCA might fail.

Even if you don't need to accept payments from European customers, it might still make sense for you to enable SCA for all transactions happening in your marketplace. The reason for this is that payments that have been successfully authenticated using 3D Secure are covered by a liability shift. From Stripe documentation: "Should a 3D Secure payment be disputed as fraudulent by the cardholder, the liability shifts from you to the card issuer. These types of disputes are handled internally, do not appear in the Dashboard, and do not result in funds being withdrawn from your Stripe account."

Credit card disputes can be costly to a marketplace. If disputes are causing you problems, enabling SCA can be a good idea.

How to take SCA into use in your marketplace

Information

If you created your Flex instance after July 2019, SCA is already enabled in your marketplace. You don't need to do anything to make it work.

If your Flex instance was created before July 2019, you will need to update your transaction process. Learn more about how the transaction process supporting SCA and Stripe integration works. If you're developing on the Sharetribe Web Template, your user interface already supports SCA, but if you're using an old legacy template without this feature, you will also need to update your checkout user interface. Learn more about how to take SCA and Payment Intents into use.

If your marketplace has been processing transactions without SCA in the past, it's a good idea to make a couple of test payments with a real credit card before publishing the change to your users, so that you can see the SCA payment flow in action.